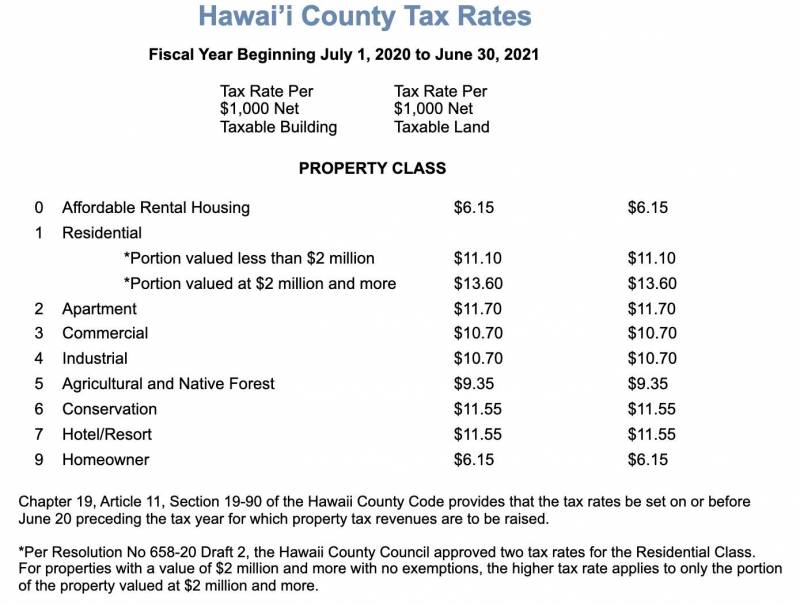

Litigating tax appeals before administrative boards and in Hawai‘i and United States tax courts. You will be charged an additional 1.5 penalty per month (18 penalty annually) beginning two months after the 10 penalty charge except for transfer tax bills. Tax Controversy and Litigation – Representing taxpayers in IRS, Hawai‘i state and county tax audits and other administrative proceedings.Also, tax planning in negotiating contracts, structuring business arrangements, submitting bid proposals, completing sales, dissolutions, and other transactions. Commercial property sold for 949k There is one uniform tax rate for all properties which is 0.10 per 100 A previously tenant occupied home sold for 949k to. Find commercial land for sale in Kauai Hawaii including vacant commercial. State and Local Tax – Structuring tax planning opportunities and managing compliance pitfalls relating to Hawai’i income tax, general excise (gross receipts) and use taxes, transient accommodations tax, public service company tax, conveyance tax, and real estate property tax. Search Hawaii County property tax and assessment records by address or parcel.Tax Planning and Transactions – Tax planning advice and consulting, including business structuring and formation, expansions, investments, mergers and acquisitions, tax-sensitive transactions (involving real or personal property, including 1031 exchanges and condemnations), tax aspects of leases, bond financing, syndications, securities offerings, tax-free reorganizations, redemptions, divestitures and dissolutions, foreign tax planning and compliance advice, and structuring and compliance work for tax-exempt organizations. Depending on the area, the conveyance tax may be a flat fee, a percentage of the sale price, or a set rate per 100, 500, or 1,000 of the sale price.

Our clients include local, national and international businesses, organizations and individuals of all types, including real estate investors and developers, financial institutions, service providers, manufacturers, retailers, health care groups and tax-exempt organizations. We provide tax-planning advice, help structure and implement tax-sensitive business arrangements and transactions, and handle tax controversy matters in administrative and judicial proceedings. Goodsill’s tax practice includes representation of business, organizations and individuals in federal, state and local tax planning, transactions and disputes. It also warned of unintended consequences for local residents and the economy.Skilled Tax Attorneys for Your Federal, State and Local Tax Needs The group questioned the bill's legality, saying the conveyance tax was never intended to generate revenue - and said the bill would impact agricultural, commercial and rental housing properties.

Whenever the title or deed to real estate exchanges hands in Hawaii, this is known as a conveyance. While the group supports addressing homelessness in the state, it questioned whether or not raising the conveyance tax was the right way to fund services. The state of Hawaii levies a conveyance tax. One of them was the Land Use Research Foundation of Hawaiʻi, a nonprofit trade group whose members include landowners and developers. Hawaii Revised Statutes 247-3 provides a long list of exemptions: (1) Any document or instrument that is executed prior to Janu(2) Any document or instrument that is given to.

In this post, we'll focus on the most common exemptions to Conveyance Tax. "If we're only building things, but you're not also hiring people to manage and maintain and build programs, then it's not going to work over the long term," StormoGipson said. To estimate how much you owe in transfer tax, you simply need to multiply your transfer tax rate by your combined transfer tax. Conveyance Tax Exemptions There are two types of taxes that apply to real estate transactions: Conveyance Tax and Income Tax. They cited employees "burning out," due to growing demands and needs from individuals, as well as the growing financial struggle to support themselves and their families. Throughout the Legislative session, advocates testified their concerns about an increasing amount of case workers leaving the field. A conveyance tax is levied on all transfers of interests in real estate. "There was nothing else being proposed that would create permanent new funding and create certainty that we will still have the ability to fund housing three, four, five years from now, and we can hire staff," StormoGipson said. HAWAII TOPIC CITATION STATUTE COMMENTARY Statute of Limitations ( Continued ).

0 kommentar(er)

0 kommentar(er)